China Deal On Track. Markets Maintain Gains

With only a few trading sessions left in 2019, traders remain optimistic heading into 2020 as both Chinese and U.S. officials appear to be on track for a partial trade deal. President Trump declared the “deal is done” on Tuesday while Chinese officials shared similar comments stating “close communication” regarding the signing of the deal is ongoing.

FUTURES FOR ALL THREE INDICES ARE UP TODAY

Major U.S. indices the S&P and Dow Jones lowered before the Christmas holiday after recording nice gains last week, while the Nasdaq is aiming for its 11th straight day of gains today. Futures for all three indices are up today with several promising developments and economic reports. Next week, we will see another shortened trading week with closed markets on Wednesday, January 1st.

(Want free training resources? Check our our training section for videos and tips!)

Current short-term support and resistance levels are $315-$325 for the SPY and we will look to buy near $315 level. Volatility is expected and we encourage readers to retain clearly defined stop-levels for all positions. For reference, the SPY Seasonal Chart is shown below:

NEXT WEEK ALSO A SHORTENED TRADING WEEK

Returning from the Christmas holiday, futures markets are seeing nice gains while the Nasdaq is on track for an impressive 10th straight record session and 11th straight in the green. Next week, we will also see a shortened trading week with the New Year’s holiday also falling on Wednesday. With only a few days left in 2019, no major economic reports or earnings are due.

WEEKLY UNEMPLOYMENT DATA LOWERED FOR THE SECOND STRAIGHT WEEK

Today, we saw the release of weekly unemployment data which lowered for the second straight week. Looking ahead, January 2020 will hold several key events including the Brexit deadline on January 31st, the first FOMC of the year will take place on 28-29, earnings season should begin mid-January, and continued talks between U.S. and China should also take place.

The latest updates regarding the “phase one” U.S.-China deal continue to uphold the current positive sentiment and optimism. After positive reports sent markets higher last week, this week we saw several comments from Chinese and U.S. officials reinforcing that notion. President Trump stated on Tuesday the deal was essentially done and in the translation phases of the signing, while Chinese Foreign Ministry officials have stated communication is ongoing as both sides are aiming to sign the deal sooner rather than later. Globally, markets were muted closing with mixed results in both Europe and Asia, although the Shangai Composite finished up 0.85%. U.S. Treasury notes and gold rose today while the dollar edged lower.

(Want free training resources? Check our our training section for videos and tips!)

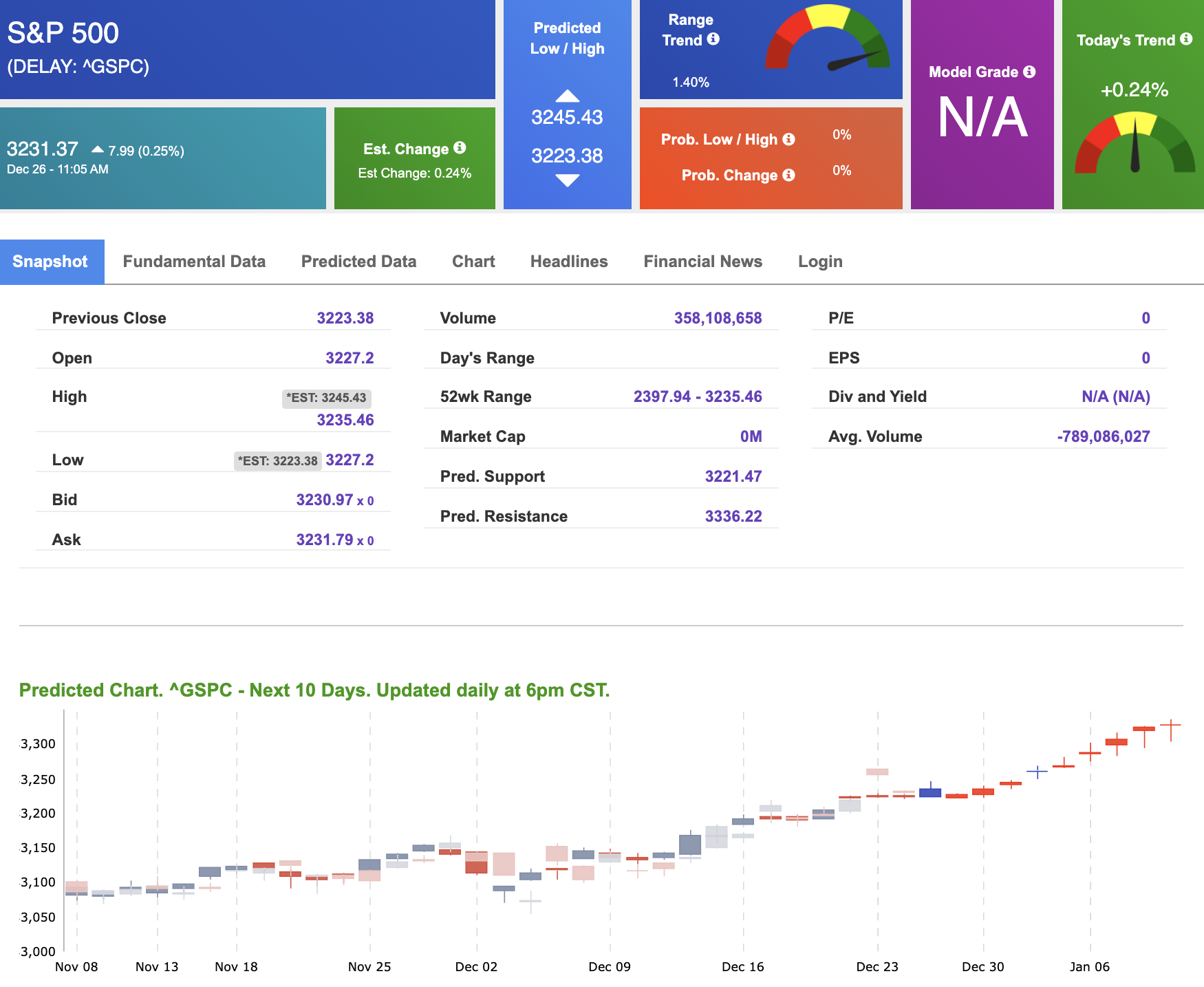

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Today’s vector figure of +0.24% moves to +0.56% in four trading sessions. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

(Want free training resources? Check our our training section for videos and tips!)