Buy Alert! Vlad’s Top 2021 ETF Picks Set To Soar

RoboStreet – December 31, 2020

A Banner Year For Our AI-Driven Investing

As we look back on the year, 2020 will easily go down as one of the most intriguing, challenging, and exciting years of stock market investing. The pandemic led to the bifurcation of winners and losers and also how the wealthy got much wealthier and Main Street where workers that don’t have the luxury of working out of their homes really struggled.

The $900+ billion-dollar stimulus package passed with $600 checks going out to everyone that makes under $75K per year. How the government can’t separate out those whose employment hasn’t been interrupted and those that are out of work is kind of insane. Those that have jobs not impacted by COVID shouldn’t be receiving stimulus checks. It’s this kind of shotgun approach that makes for bad government policy when the technology to properly distribute taxpayer-funded money is available.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

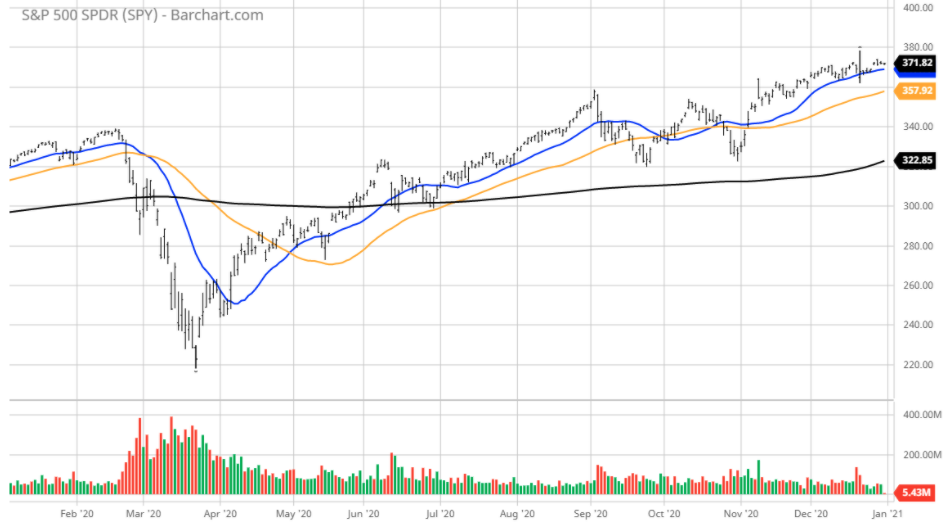

Per the market landscape, the SPY continued to make incremental gains for the week. All asset classes rallied into the end of the week except mega-cap technology stocks (AAPL, MSFT, AMZN). The SPY $364 level is the key support level short term. The U.S. Dollar and the Treasuries continued to trade in the downtrend.

As long as the SPY is trading above the $364 level, the SPY will continue to make incremental gains and can reach the $375-$380 level by the first couple of weeks in 2021. However, the bulls have been losing momentum and are prone to a 5-10% correction in January-February after which the bull market should resume its rally and will continue to make new highs into March-April.

I would be a buyer using any short-term corrections and use a dollar-cost averaging strategy to accumulate positions.

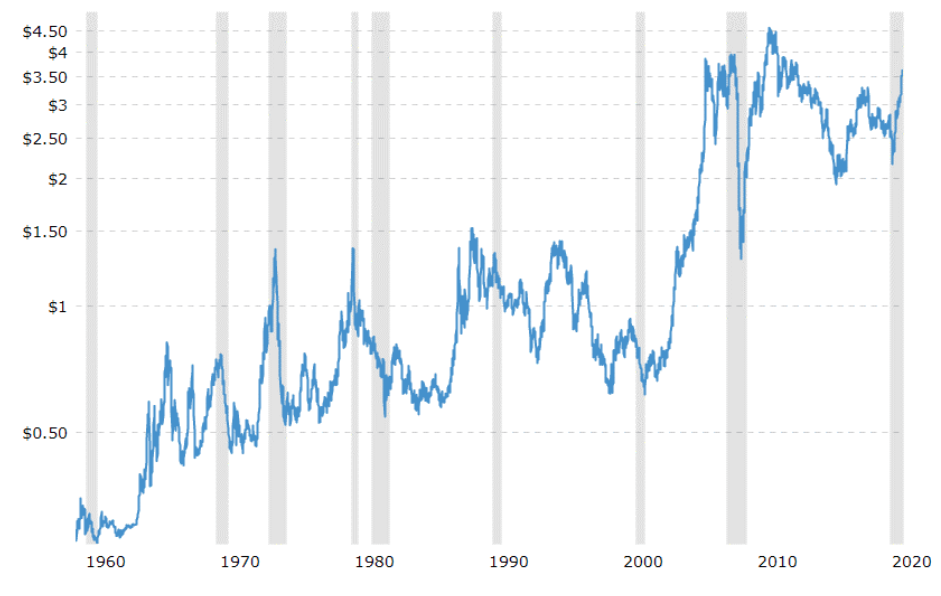

With so much focus on the Georgia Senate runoff and the risk that might bring to the U.S. market, there is an upside breakout price action in the commodity space and emerging markets that really aren’t correlated to domestic politics. Copper is trading at levels not seen since 2010 led by strong demand in Asia.

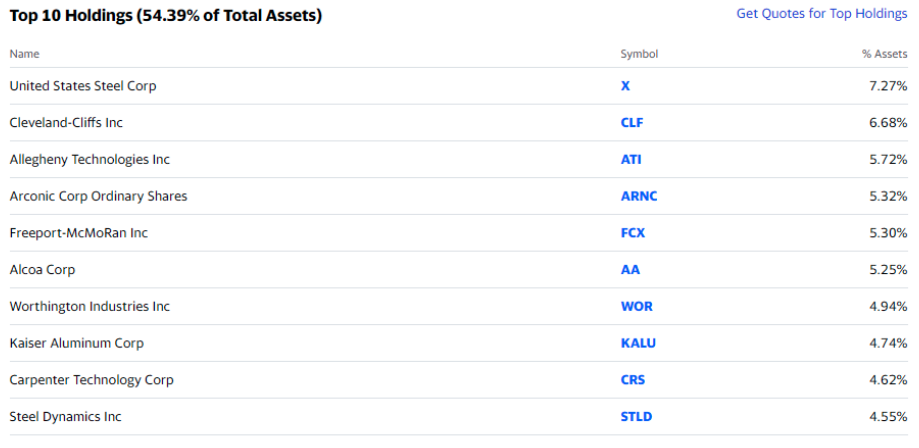

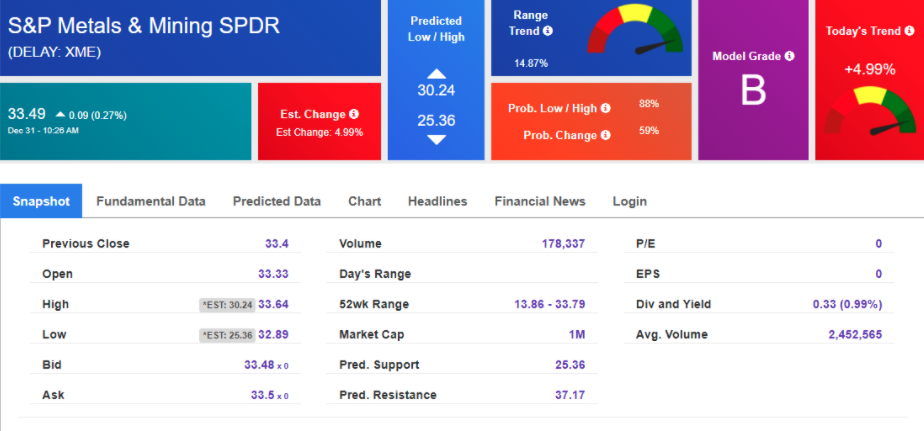

But it’s not just copper that is on a tear, iron ore, hot rolled steel and aluminum are all exhibiting bullish price action, which portends an industrial recovery on a global scale. Shares of the SPDR S&P Metals & Mining ETF (XME) offer investors an ideal way to play the strength in the sector of which the top ten holdings are of the leading stocks in the space that are in full rally mode.

When we apply our proprietary AI tools to XME, our Stock Forecast Toolbox has a Model Grade “B” rating on the shares with a near-term price target of $37.17, or roughly 10% higher than where the stock currently trades. Given the strong fund flows into the sector, this price target is probably going to see several upgrades going forward.

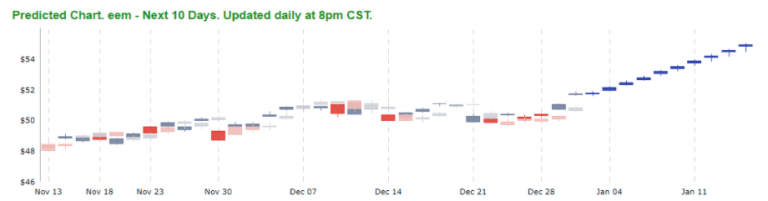

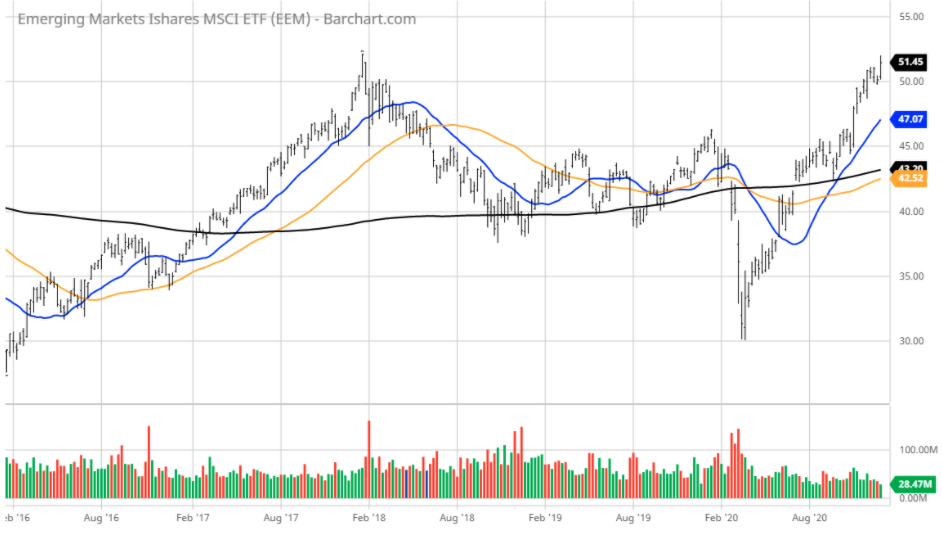

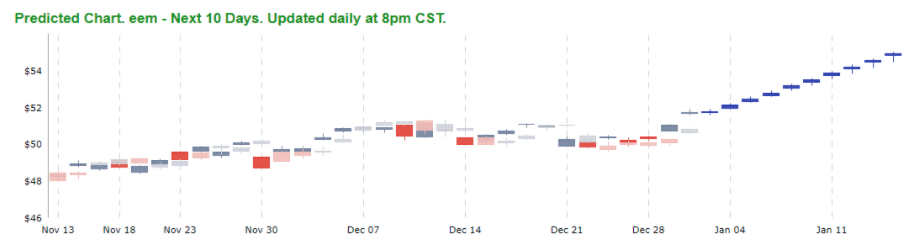

Within our RoboInvestor advisory service, we have been in and out of the position over the past couple of years. Coming into 2021 with the market vulnerable to a mild correction following a big year-end run-up, we’ll be looking to get long XME for our members, so make sure you’re in on this trade when we issue a buy recommendation. In another major breakout development, shares of iShares MSCI Emerging Markets ETF (EEM) are in the process of breaking above their early 2018 all-time high, which would be a huge technical development. A weaker dollar is strengthening the exchange rate of many emerging countries that increases their buying power around the world and it’s showing up in strong capital flows into ETFs like EEM.

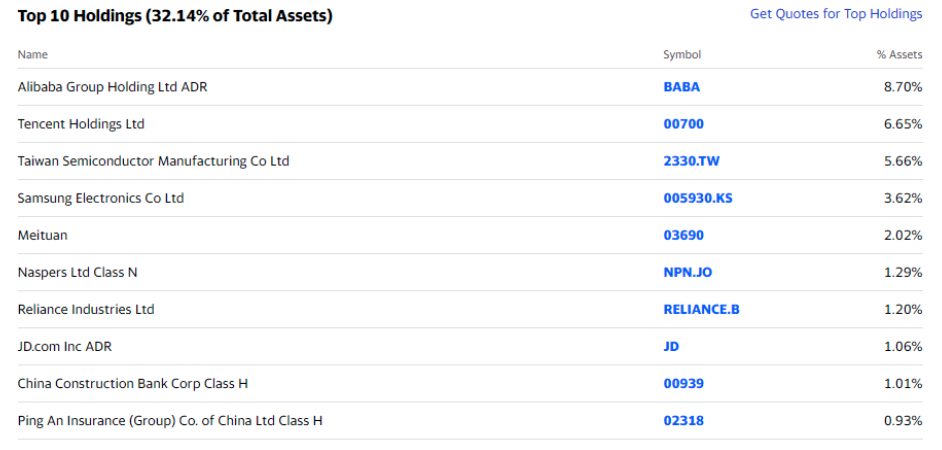

The top ten holdings within EEM are led by China’s Alibaba and Tencent with chip juggernaut Taiwan Semi and Samsung Electric rounding out the top four components.

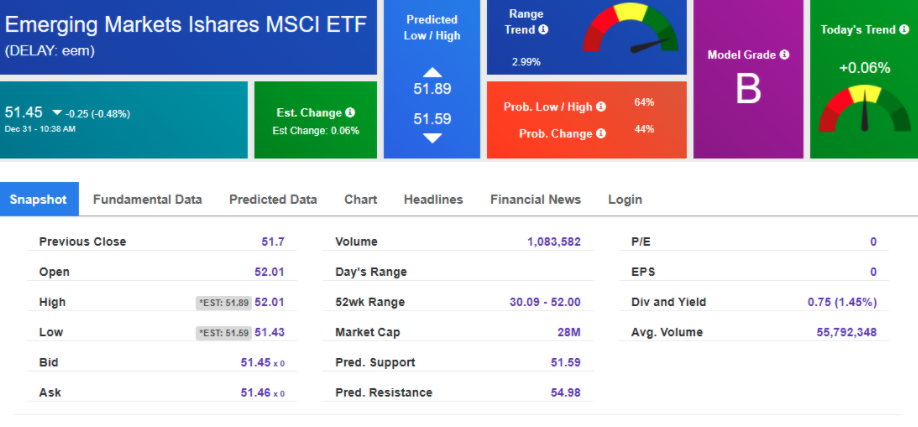

Similar to the XME, our Stock Forecast Toolbox is bullish on shares of EEM heading into 2021, giving the stock a Mode Grade “B” rating as well.

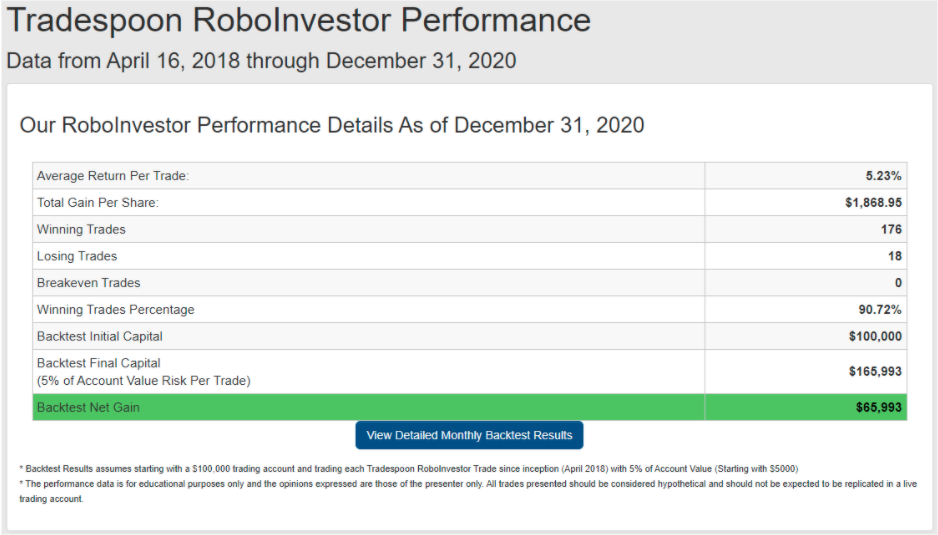

Here too, we are excited about the price action of EEM and will look to add this ETF to our RoboInvestor portfolio in the near term, provided the market gives us a much-needed pullback to refresh the bull trend and relieve it of its overbought condition. As to our RoboInvestor track record, I’m not aware of any other retail stock and ETF advisory service that has a Winning Trades Rate of 90.72%. That’s just a torrid winning streak that goes back to April 2018.

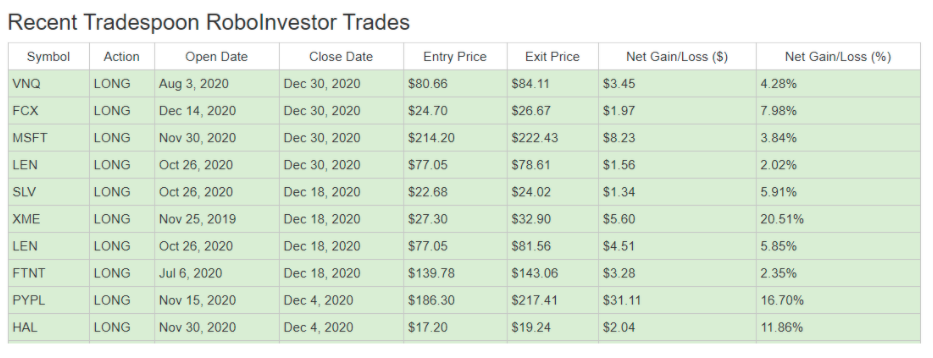

For the month of December, we closed out ten trades, all for nice profits. We take a full position when we buy and will many times sell 50% initially and another 50% at higher exit points. In doing so, we are scaling out into strength and redeploying proceeds into new recommendations that are generated by our AI-platform.

Within RoboInvestor we only invest in the biggest-cap, most liquid, and most favored institutional equities and ETFs that represent all manner of stock sectors, bonds, interest rates, currencies, commodities, and volatility. Our AI platform is unrestricted as to what it generates in the way of high-probability investment ideas. Take us up on our year-end offer and make RoboInvestor your last best trade for 2020 and begin 2021 with a hot start with the best AI trading system on the market anywhere!

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.