Buy Alert! Specialty Retailer Set to Break Out

RoboStreet – December 19, 2019

Santa Claus Rally in Full Swing

By definition, Wall Street labels a rising market the last two weeks of December as the infamous “Santa Claus rally,” and this year it looks as if Santa showed up with a fully loaded sleigh. The bullish trend that triggered a fresh upside breakout for the S&P is intact and broadening out to include all 11 sectors – with even energy showing early signs of participating after suffering a heavy year-end tax-loss selling pressure.

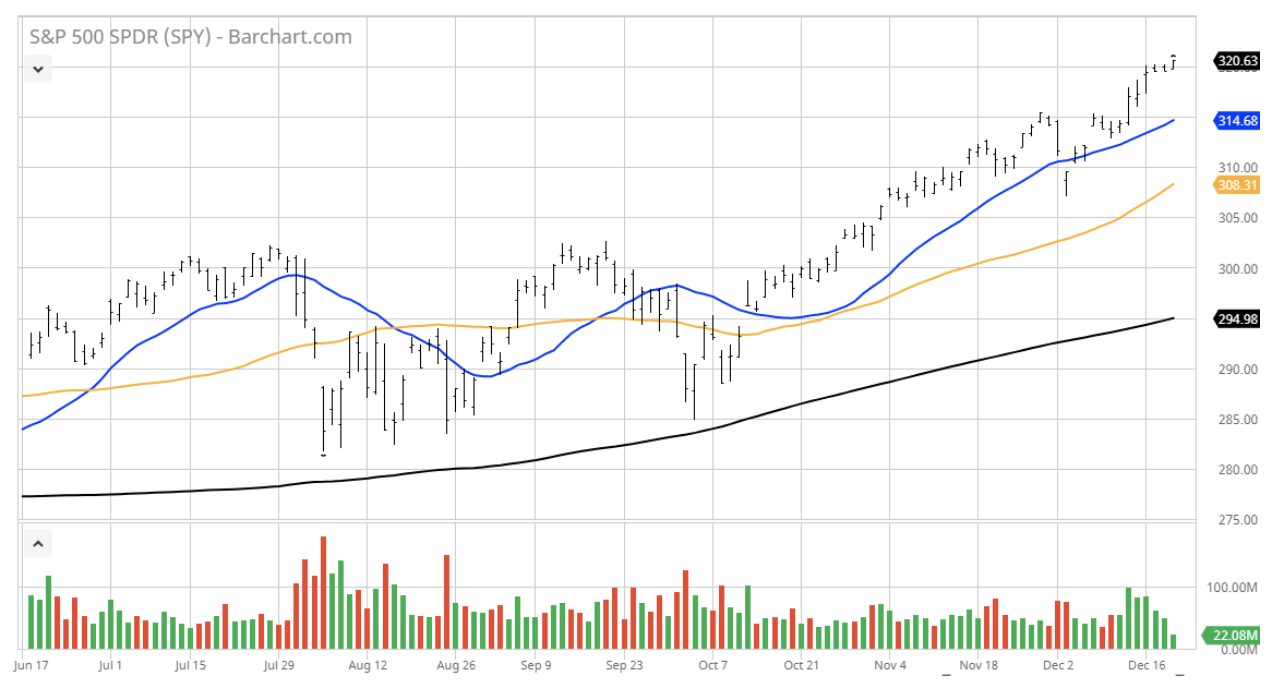

The S&P has some minor resistance at 3,200 and typically after an extended move up such as the most recent, investors should expect shallow corrections heading into January. Using a 6-month chart of the S&P SPDR (SPY), there is rising technical support at 315 (20-day m.a.) and then at 309 (50-day m.a.).

(Want free training resources? Check our our training section for videos and tips!)

One compelling argument that is circulating is what will happen with the record amount of cash and money markets heading into 2020. There is over $3.4 trillion sitting on the sideline that sat out the rally due to concerns over the impact of a full-blown U.S./China trade war.

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

With the phase one deal moving toward being completed, the uncertainty of Brexit off the table and the Fed telegraphing their fiscal policy is on hold, there is little in the way for the bulls to keep pressuring all that cash to get back into stocks. This is particularly true if the forecasters are correct about a reacceleration on the global economy.

China’s PMI rose to 50.2 in November from 49.3 in the previous month, and ahead or the 49.5 estimates, showing the first month of expansion in factory activity since April. The U.S. PMI for December came in at 52.5 down from November’s read of 52.6, but both readings are still above the key 50.0 level that indicates factory growth. U.S. PMI data was below 50.0 from May through October, so seeing manufacturing activity pick up the past two months coupled with China’s positive read is notably bullish.

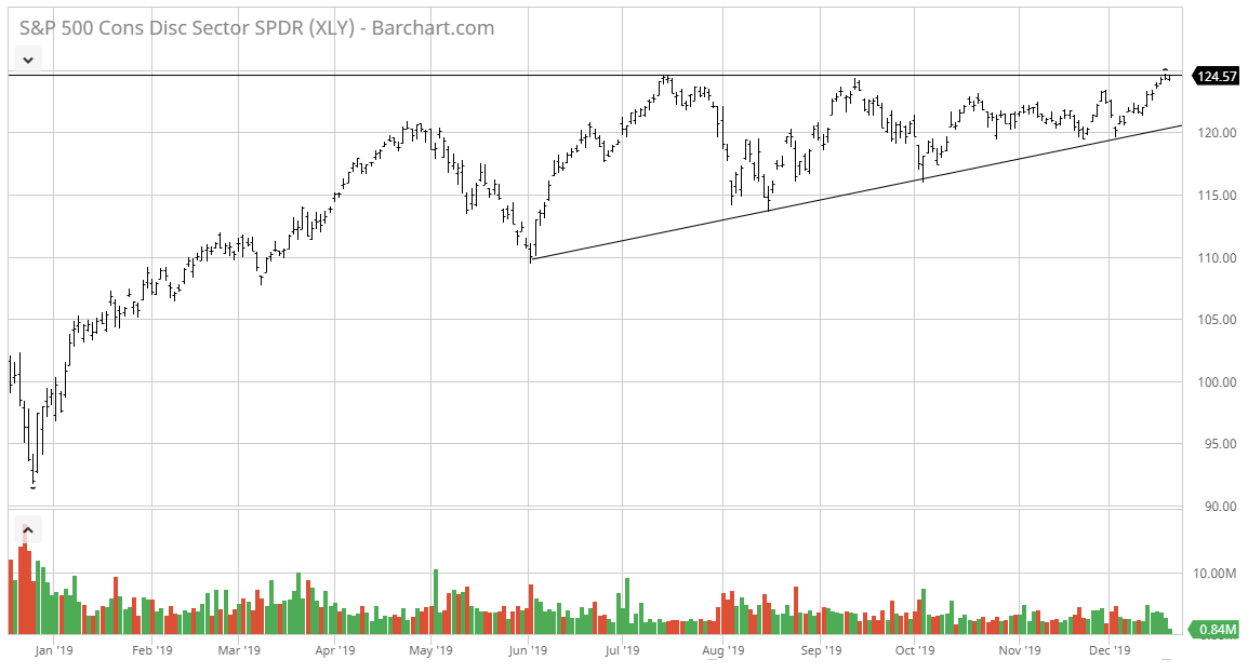

Under the assumption the domestic and global economies are going to resume a faster rate of growth in 2020, it bodes well for the consumer discretionary sector to benefit from a further rise in personal spending. The Consumer Discretionary Select Sector SPDR ETF (XLY) has been forming what technicians call an “ascending pennant formation” where there is an overhead level of resistance (in this case at $125) and a series of higher-lows from any bouts of consolidation.

This chart pattern almost always results in a and upside breakout, which in this case could produce a 10% move in a matter of weeks or a couple of months. Grant it the S&P is a bit overbought and likely due for some well-deserved back and filling, but any pullback by shares of XLY to $121 should be considered an attractive entry point.

What’s interesting about XLY is that of the top 10 holdings that make up roughly 60% of the ETF’s total weighting, only three stocks are trading at or near their 2019 highs – Nike Inc. (NKE), Lowe’s Corp. (LOW) and Target Corp. (TGT). This is almost a perfect set up for the XLY to push higher when the other notable stocks get up some momentum either individually or collectively.

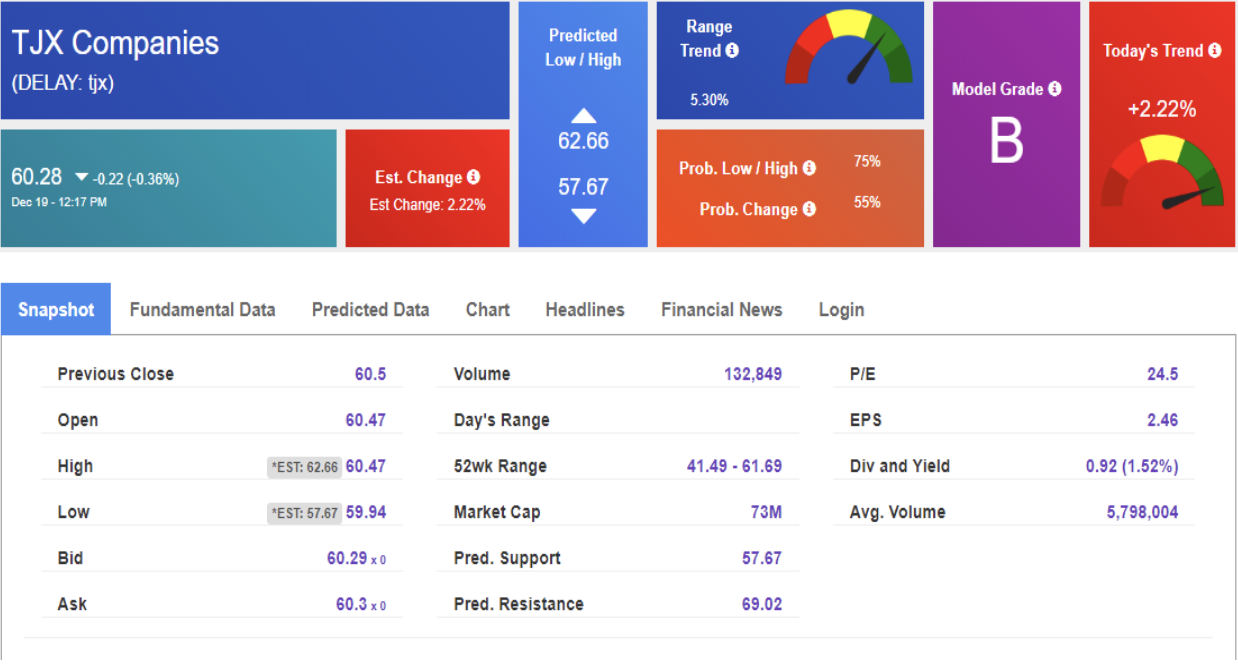

With this list of the top ten holdings, one stock on the verge of a bullish and timely breakout is TJX Companies (TJX) – the off-price apparel and home fashions specialty retailer which owns T.J. Maxx, Marshalls, HomeGoods, Winners, HomeSense, T.K. Maxx, and Sierra Trading Post. The company owns about 4,300 stores in the U.S. and overseas and carries a market cap of $72.6 billion.

When we apply our AI-driven tools to shares of TJX, we get a positive Model Grade of “B”, which is bullish and a predicted resistance level of $69.02 for the stock. Given that TJX shares are trading at $60.30 as of yesterday, we’re looking at a forecasted gain of 14.4% to be realized in a name that is an institutional favorite.

This is when our RoboInvestor advisory service does its best work – identifying blue-chip stocks in sectors on the verge of a breakout that is also in bullish patterns where strong uptrends lie just ahead. Having the power of AI at work 24/7 in one’s portfolio affords the luxury of being in those stocks and ETFs before the crowd starts plowing in.

Within the past year, we’ve traded other heavyweight retail stocks like Amazon.com (AMZN), Wal-Mart Inc. (WMT), Lulu Lemon Athletica (LULU) and Estee Lauder (EL) for solid profits. We are currently long Target Corp. (TGT) at a cost basis of $106.81 back on September 3 and the stock now trades at $128.50 or roughly 20% higher and far outpacing all the major averages.

The RoboInvestor Portfolio has delivered a winning percentage rate of 88.79% going back to April 2018 when we launched the service. This is the stuff hedge funds and professional money managers would kill for, and the fortunate thing is that I make this kind of torrid market return available to everyday investors.

Heading into the last week of 2019, the RoboInvestor Portfolio is long and enviable set of stocks and ETFs. Shares of J.P. Morgan (JPM), NXPI Semiconductors (NXPI), BlackRock Inc. (BLK), iShares Russell 2000 ETF (IWM), Invesco QQQ Trust (QQQ) are all hitting new highs this week and I’m looking at adding TJX Companies (TJX) to the portfolio when my indicators give me the green light on the next market pullback.

In fact, I’m going to be recommending two new stocks this weekend to RoboInvestor subscriber, neither of which is TJX, but instead one is in the healthcare sector and the other in the basic materials sector. Both stocks are industry leaders and institutional favorites with terrific fundamental and technical characteristics that have been “green-lighted” by my AI platform. To get in on these next two trades and for all of 2020, join RoboInvestor today and make 2019 a year of major positive change in how wealth is accelerated in your portfolio.

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”