Alert! Vlad’s AI Model Flashing Mega-Tech Sell Signal

RoboStreet – April 29, 2021

Selling Mega Tech Into Strength

This week has been highlighted by a key FOMC meeting and pivotal earnings releases from the companies whose stocks are the most heavily weighted components in the major indexes. As shares of Apple Inc. (AAPL), Microsoft Corp. (MSFT), Alphabet Inc. (GOOGL), Facebook Inc. (FB) and Amazon.com Inc. (AMZN) go, so goes the market.

Mixed price action for the FAANG

As the week unfolded, the scorecard showed broad revenue and earnings outperformance, but mixed price action for the FAANG and Mr. Softie line up. The biggest surprises came from Microsoft, which reported stellar numbers from all its divisions only to see the stock trade down from $263 to $251, while Facebook beat estimates but guided the second half of 2021 sharply lower, and its stock still traded to a new all-time high.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Apple put up monster numbers and the stock got absolutely no love from the Street. I didn’t even see any brokerage firms raise their price targets in a material way, indicating the current P/E of 36x is all they want to pay for the stock at this time. In any other prior time, shares of AAPL would have vaulted higher. This is quite a tell for the market.

Alphabet posted excellent Q1 results and its shares acted accordingly, trading to a new all-time high as ad spending is ramping again. Amazon is trading near its record high in front of its release due out after the close Thursday and after I’m writing this blog, so it will be interesting to see if selling on the news also impacts AMZN shares. Netflix reported a week ago and its shares were summarily crushed as subs came in light.

What these reactions are telling us is, that aside from some knee-jerk euphoric pops on the earnings, the market has priced in a lot of good news. As we head into the month of May, investors need to be on guard for signs of distribution by institutional investors. As the S&P hit 4200 Thursday, there was some notable selling pressure at that level.

Here’s my technical take:

The $SPY continues to trade in the range between $410 and $420. The energy stocks led the market. The semiconductors started the correction. The $DXY is reaching oversold levels and started the bottoming process. The $TLT is trading in the uptrend. Short term key support level is at $410 and the market can potentially start the correction in the next two weeks.

I would consider raising cash at this point as the best part of the recent rally is behind us. Based on our models, the $SPY can pull back 10-15% in the next 2-6 weeks. If you are trading options consider selling premium with September and October expiration dates. Based on our models, the market (SPY) will trade in the range between $388 and $420 for the next 6 weeks.

SPY vulnerable 5-7% correction in the latter half of May

Depending on how the first week or two of May trades, my work suggests the SPY is vulnerable to a 5-7% correction in the latter half of May. Typically, these are the garden-variety type of pullback, where the selling pressure lasts no more than a couple of weeks. But with so many leading stocks in overbought territory, there is good reason to be cautious about having too much market exposure.

It’s exactly when we get into these kinds of markets where uncertainly creeps in that investors can truly benefit from the power of AI. Such data-crunching tools are the basis of our RoboInvestor advisory service that has a winnings trades percentage of 91.07% over the past three years.

9 out of every 10 trades

Our AI platform models trades that involve blue-chip stocks and ETFs that encompass market sectors, interest rates, currencies, commodities, and volatility. Our indicators reveal where the highest percentage trades exist for capturing consistent profits – better than 9 out of every 10 trades to be sure.

Sell signal for Apple

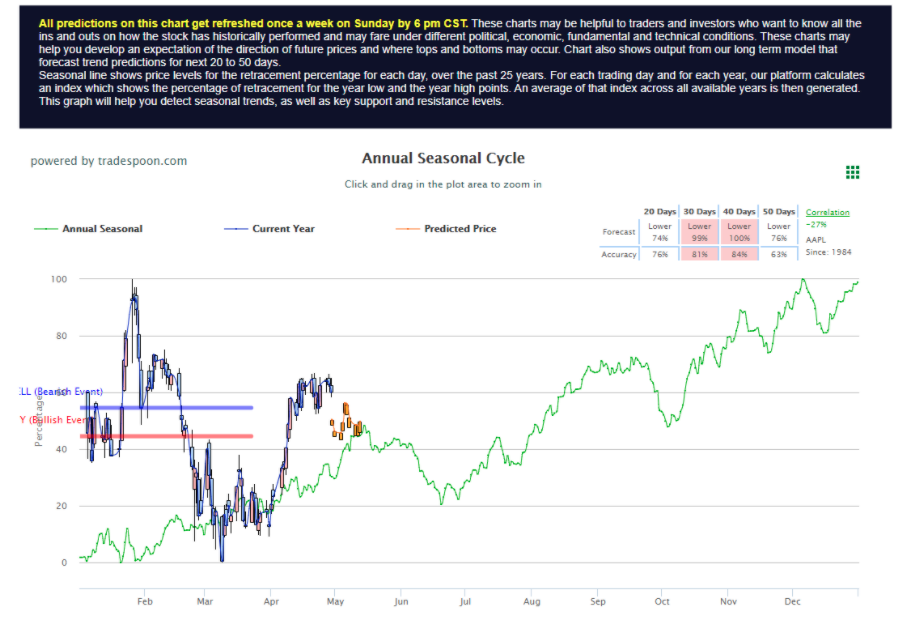

Take for example Apple Inc. (AAPL). Our AI-driven Seasonal Chart shows all four 20, 30, 40 and 50-day periods flashing “Lower” probability readings. When we get this kind of across-the-board sell signal in Apple, it’s not good for the stock or the market.

Many have difficulty knowing when to sell stocks

Most investors have no problem buying stocks, but many have difficulty knowing when to sell stocks. Having a sell discipline that is as constructive as one’s buy discipline can be hard to develop without years of experience. Our AI platform takes care of removing the emotion and guesswork from when to exit positions. It’s one of the greatest features we offer to RoboInvestor members and is a testament to our enviable track record.

Make a significant difference in how you build wealth

We could be entering a classic “sell in May and go away” market landscape, so don’t be without an indiscriminate set of AI tools at your disposal and a service that will guide and navigate your portfolio to steady gains while avoiding trouble spots and unforeseen risks. Take us up on joining RoboInvestor and put my cutting-edge AI platform to work in your portfolio today and make a significant difference in how you build wealth.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. Not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.